In the world of mergers and acquisitions (M&A), having the right software tools can greatly streamline the entire process. Whether you’re a professional in private equity (PE), venture capital (VC), or part of an internal M&A department, these top M&A platforms are designed to make deal-making more efficient.

7 Top M&A Software Tools

1. DealRoom: Streamline Deal Lifecycles

- DealRoom is a comprehensive M&A project management platform that covers the entire deal lifecycle.

- Features include M&A pipeline management, due diligence activities, virtual data room (VDR) document exchange, and post-merger integration.

- Customizable dashboards enable users to compare data points for multiple opportunities simultaneously.

- Pricing varies based on usage. For a single sale or merger management, it’s $1,495 per month. For more extensive needs, plans start at $11,995 per year, with options for companies with large pipelines or frequent mergers.

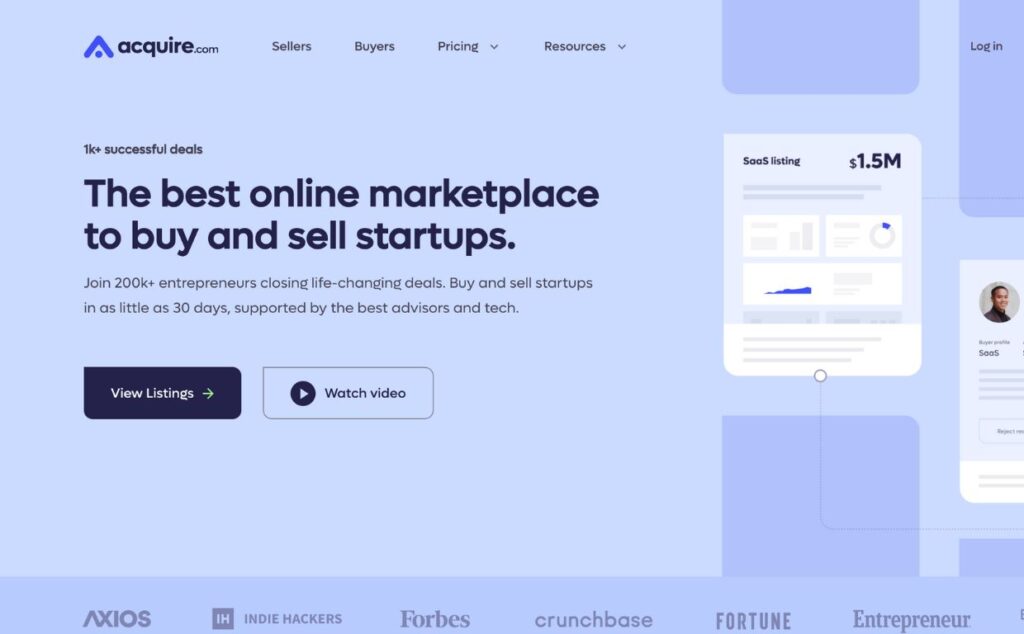

2. Acquire: Simplify Startup Buying and Selling

- Acquire operates as a marketplace-style acquisition platform, making it easy to find or list startups for sale.

- Transactions on Acquire can be completed in as little as 30 days.

- Browse listings for free or choose from paid plans starting at $390 per year. When selling, a 4% commission applies upon successful transactions.

3. iDeals: Secure Buy-Side Document Sharing

- iDeals is a dedicated virtual data room (VDR) solution for secure document exchange.

- Ideal for due diligence, pre-merger activities, and post-merger integration, with GDPR and HIPAA compliance.

- Pricing is available through customized quotes, ensuring a tailored plan for your needs.

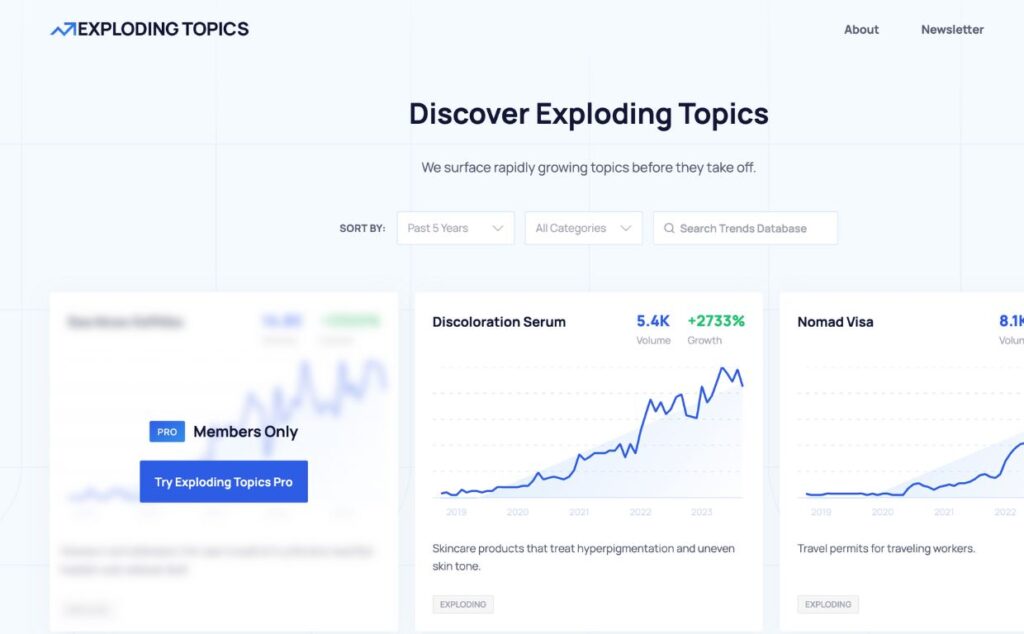

4. Exploding Topics: Research New Startups

- Exploding Topics is a research tool focused on identifying industries to invest in and valuable startups ripe for acquisition.

- Gain insights into emerging startups, industry trends, employee count, and more.

- Start exploring the database for just $1, with access for as little as $79 per month (billed annually) for more features.

5. Grata: Target Middle-Market Acquisitions

- Grata offers a database of 10 million middle-market companies for potential acquisitions.

- Search for specific companies or explore businesses within target industries.

- Listings include verified executive contact information.

- Pricing and plans are available upon request.

6. Datasite: Ensure Compliance

- Datasite provides end-to-end M&A transaction management with regulatory technology for ongoing compliance.

- Features include project progress snapshots, complete audit trails, document indexing, and more.

- Pricing is available through custom demos and quotes.

7. Ansarada: Ideal for Growth Stage Startups

- Ansarada supports both buy-side and sell-side M&A activities, offering tools for raising venture capital, investment compliance, document sharing, and more.

- Prices start at $399 per month or $240 per month (billed annually) for full access, with variations based on data storage needs.

In conclusion, while it’s possible to manage M&A activities without dedicated software, these platforms can significantly enhance organization and efficiency, particularly when dealing with compliance. Investing in reputable M&A software is a valuable step toward maximizing the return on your efforts in the world of mergers and acquisitions.